If you have initiated a company incorporation in Singapore then, it is time for you to settle your financial affairs and learn the logistics of calculating taxable income for Singapore companies. Hiring outsourced accounting services Singapore or corporate tax services is one way to estimate the taxable income for companies based in Singapore or, you can learn the fundamentals of the process on your merits.

When new businesses are required to submit their annual filings, they should familiarize themselves with on how to calculate corporate tax in compliance to the Singapore tax laws. Usually, entrepreneurs are expected to pay an income tax of 17%; however, they should learn the deductible items and other elements to reduce the income tax rate on their income.

Type of tax system in Singapore

Singapore operates on the basis of territorial tax system, which implies that a company should be responsible for paying corporate income tax on the overseas income earned in the country. For instance, if you have earned income outside of the country then, the following areas would be determined to estimate your overall tax:

- Yields generated from the company’s investments

- Trade profits

- Income earned through trademarks and premiums

- Income gains

How to calculate the income tax of companies operating in Singapore:

Before you consider computing tax income for your company, you should be familiar with the process of reducing corporate tax on your company operating in Singapore before you sign the C-S/C form. For instance:

- If you are working on Form C then, it should be submitted along the computation tax of the company, as well as you should submit the supporting schedules and financial statements to IRAS.

- If you are asked to compile the Form C-S then, you should make sure to include financial statements and other paperwork for the process.

Types of adjustments:

When you are on the verge to prepare and compile paperwork for your taxable income then, you should take the following types of adjustments into your account:

- Deduct the non-taxable income

- Deduct non-trade investment income from dividends of your company

- Consider the disallowable company expenses

- Add direct expenses and indirect expenses to your investment income

- Consider net investment income to calculate the taxable amount

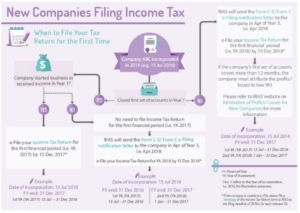

Below are the basic guide for New startup companies:

Paying taxes is a crucial part of operating a business in Singapore; however, the Singaporean government is lenient and it doesn’t require you to pay a lucrative tax on your generated income. Once you have accomplished the criteria for single-tier corporate tax payment then, you wouldn’t be expected to pay more than 7-11% tax on your income and dividends.

On the contrary, if you were to pay an excessive income tax on your revenue then, you can take the deductibles in your account to estimate the overall amount that would be returned to you. Work with the best accounting firm in Singapore to discuss your matter and make sure you do not misplace any important paperwork crucial for calculating your taxable income.

QUICK ENQUIRY FORM